Move Forward To Payday With One Application

Credit intermediary not a lender. Representative Example: Amount of credit: £1000 for 11 months at £102.22 per month. Total repayment of £1226.64. Interest: £226.64 Interest rate: 47.5% pa (fixed). APR rates range from 9.3% APR to 102.5%.

Wage Day Advance

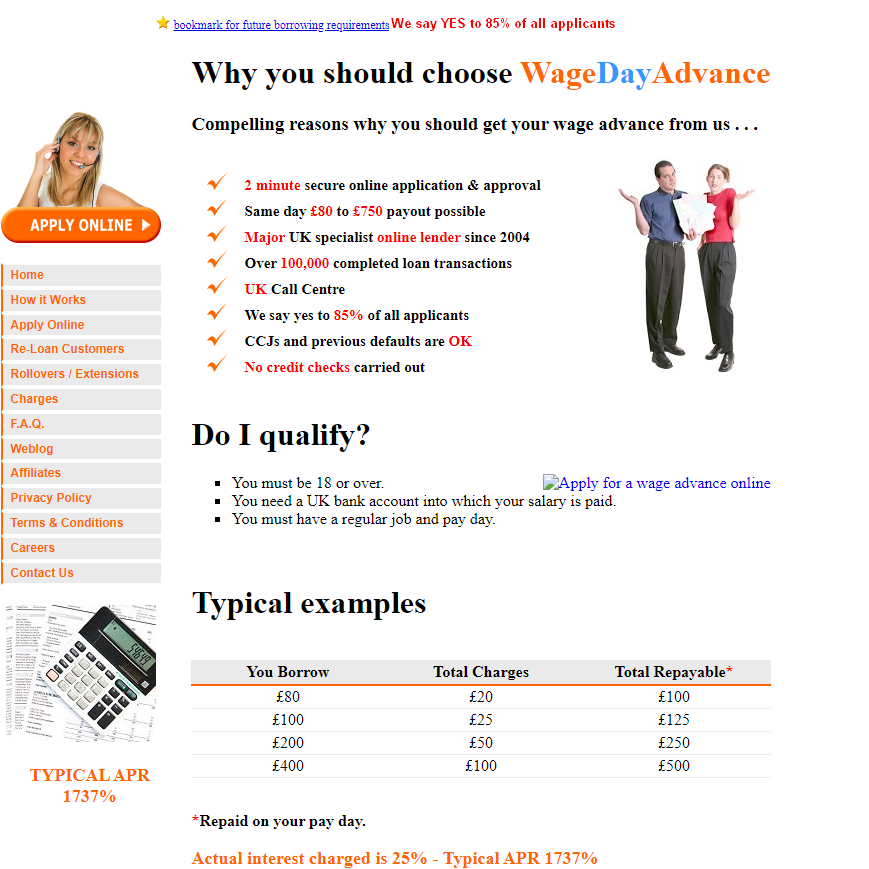

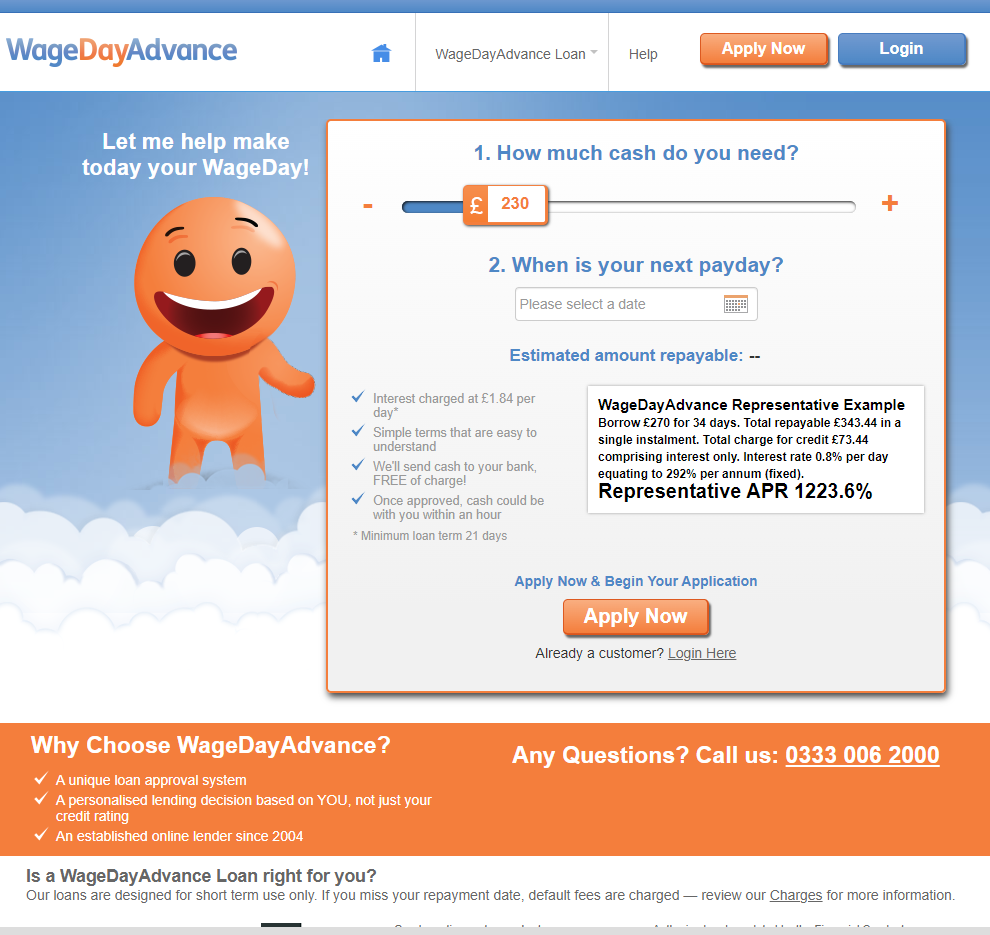

"Wage Day Advance Ltd" began its operations as Wage Day Advance in April 2001 and surprisingly didn't embrace online operations until 2007. This shift allowed them to expand from being a local lender in Keighley to serving customers across the UK. Entering the online market coincided with the Payday Loan boom in the UK, a period that attracted major US lenders to the market.

Although Wage Day Advance was a small startup, it effectively embraced internet lending. While not the largest brand in the market, it was still well utilized. At its peak, Wage Day Advance was issuing about 3% of the loan volume that a larger lender like Wonga managed, which amounted to approximately £7 million annually.

WDA's Financial and Corporate Background

Incorporated in 2001, Wage Day Advance Ltd initially filed accounts exempt from detailed reporting, likely due to low turnover. This situation changed in 2011 when the company reported £1.8m paid in dividends to shareholders. The financial landscape remained stable until 2015, when Wage Day Advance filed a loss of £7.2m, with similar substantial losses recorded in 2016 and 2017.

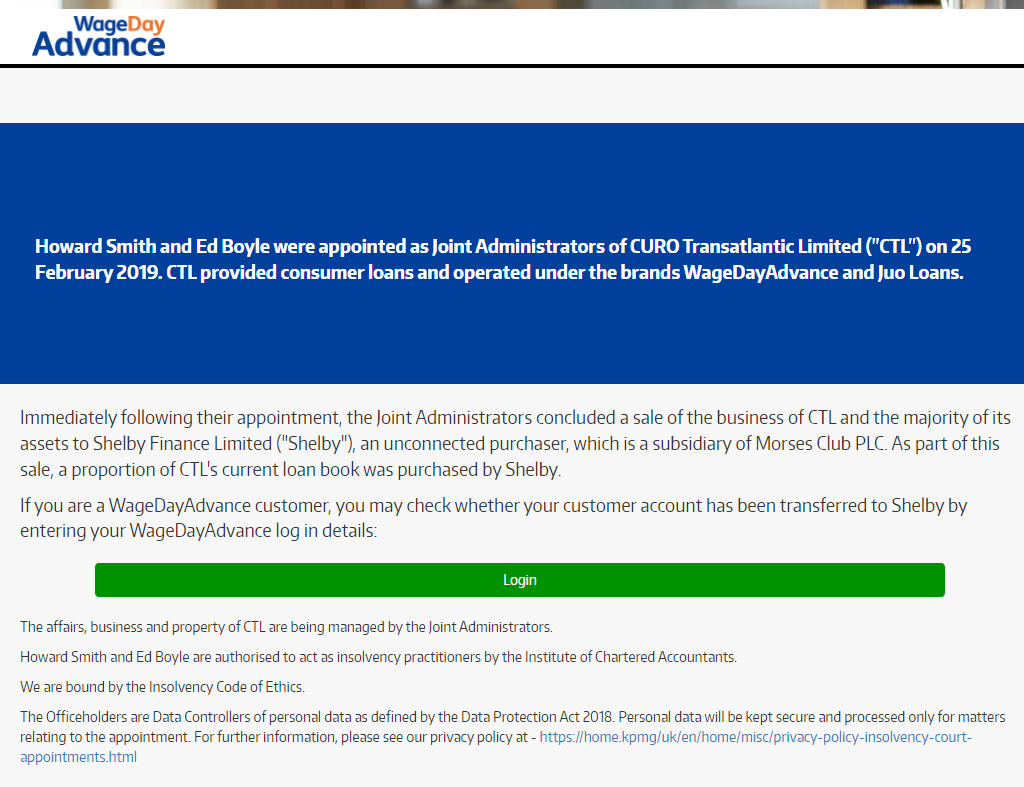

For reasons not publicly disclosed, the company underwent a rebranding in 2017, changing its name to "Curo Transatlantic Limited." This phase of the business concluded dramatically on March 12, 2019, when the company entered insolvency. KPMG was appointed to administer the process. The winding down of the company, including the liquidation of its assets, extended over two years, culminating in the dissolution of the company (registration number 04179322) on June 5, 2021.

Wage Day Advance Stopped Direct Lending

The story of Wage Day Advance is identical to that of most other direct lenders that went bust. They were profitable up until the introduction of the Financial Conduct Authority (FCA) in 2014. With the FCA came price caps, limited rollovers of loans, and compensation for the historic mis-selling of loans and other credit products like PPI.

These changes hit UK subprime lenders hard, and while WDA managed to continue until 2019, its downfall was inevitable, merely a matter of time. WDA was operationally profitable right until the end—if one were to exclude the costs associated with claims of mis-selling, WDA could have continued well into the 2020s and beyond.

Although it was not a high-street lender and had no physical premises, its closure still resulted in the redundancy of 26 staff members: five directors and 21 administrative staff who handled the day-to-day operations.

WDA's exit from the payday loan market marked a sad time for the industry. The year 2019 saw a significant reduction in choices available to UK consumers. Almost five years later, that choice has still not been restored, with only three payday lenders operating in the UK as of 2024.

|

|

|

| If approved, can I borrow over 1, 2 or 3 repayment periods? | No* | Yes* |

| What is the standard fee for fast funding? | Free | Free |

| How much can new customers borrow? | Up to £500† | Up to £1000† |

| How much can returning customers borrow? | Up to £1000† | Up to £1500† |

| What is the maxium total amount repayable for an 90-day, £300 loan? | NA | £642.00 |

| What is QuickQuid's advertised representative APR? | 79.5% | 47.5% |

Mis-sold a Wage Day Advance Loan - Compensation

Sadly, if you believe that you were mis-sold a loan from Wage Day Advance, you will no longer be able to apply for compensation. KPMG has paid out all the creditors and dissolved the company in June 2021. Effectively, the company "Curo Transatlantic Limited" no longer exists; there is nobody to file a claim with - it's gone.

We are aware of another company providing services on that website, but it is completely different from the company that did the mis-selling. The current operator of the brand has zero links to the old provider. Complainants would be wasting their time reaching out to them for a resolution.

Alternative Payday Lenders

Wage Day Advance FAQs

Questions Not Answered Elsewhere

Is It "WageDay Advance" or "Wage Day Advance"?

With this brand, "Wage" and "Day" are two separate words. In the English dictionary, "wageday" is similar to "payday" and should be one word. However, for this brand, they spelled "Wage" and "Day" as two separate words. This can be seen in the company formation documents where it is listed as "Wage Day Advance Limited."

Was WDA A Big Lender?

No, not on a large scale. They accounted for less than 3% of the total amount loaned by UK payday lenders in 2015, which was the busiest year for payday loans in the UK. However, they did lend over £7 million in 2015, so it wouldn't be accurate to label them as a small lender either.

Did Borrowers Ever Get Compensation?

BBC Wage Day Advance Compensation Claims The BBC reports that complainants received less than 6p in the pound, meaning that if a former borrower was due £100 in compensation, they would receive only about £5.68 from the administrators.

Some borrowers, who had been told they could claim as much as £2,000 in redress, were shocked when they received a cheque for just over £113. Others said they weren't surprised by the outcome.

With all lenders that fell into insolvency, a large proportion of the money is used to pay the administrators. The leftovers for actual borrowers are typically very small amounts. In this instance, KPMG were charging over £20,000 a day plus fees to wind up the business.

Too Late To Claim?

The deadline to file a claim was March 2020, and since the company no longer exists, it is impossible to submit a new claim.

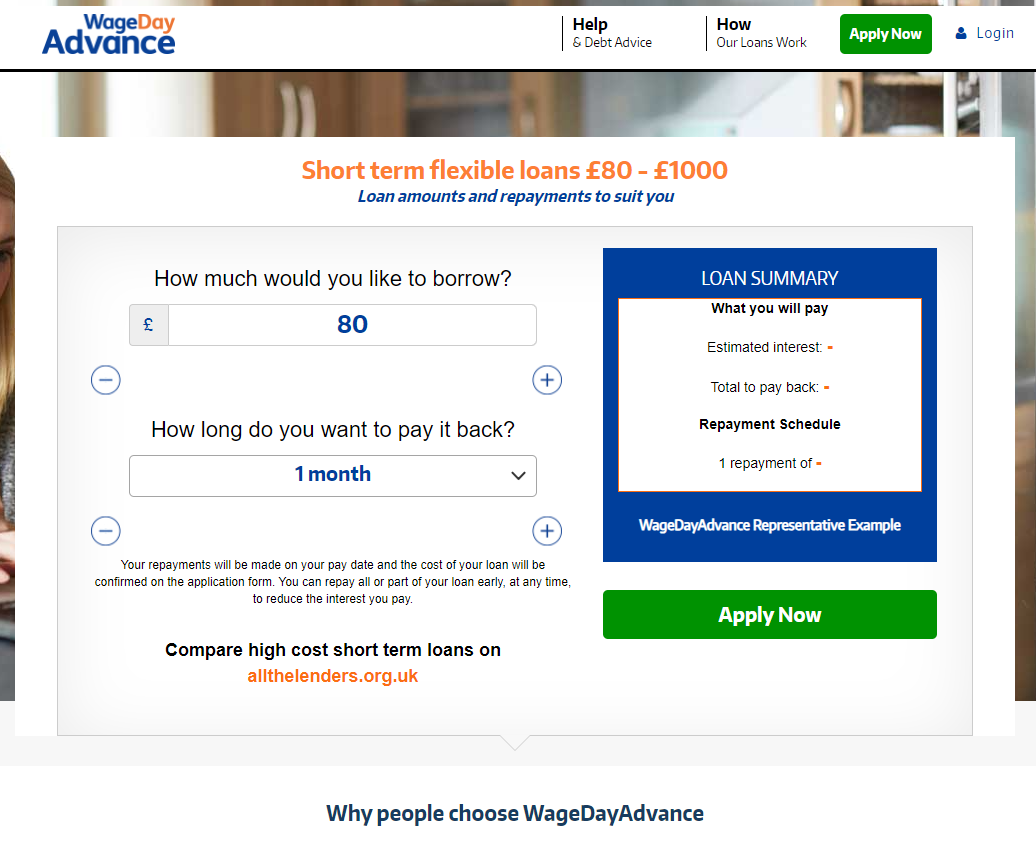

Will Wage Day Advance Make A Comeback?

Wage Day Advance has already returned as a broker under new ownership, but not as a direct lender. The chances of it ever returning to lending its own money are almost non-existent. Lenders now typically separate their lending brands from their loan books. This is done to firewall both parts so that if the loan book entity collapses due to issues like mis-selling, it will not lead to the collapse of the most valuable part—the branding and the intellectual property.